Canada MSB License

Payment systems are essential in the Canadian financial sector, as are banks.

Payment systems are essential in the Canadian financial sector, as are banks.

Swiss authorities are closely monitoring the rapidly-developing FinTech services market and responding promptly to innovations.

In order to carry out money services activities, it is necessary to have an MSO (Money Service Operators) license.

The United Kingdom is one of the best jurisdictions to obtain a license.

Currently, Lithuania is an advanced fintech center in the EU and is ranked 4th in the Global Fintech Index 2020.

The Republic of Bulgaria has a special PSPSA law that specifies the electronic payment licenses features.

The institution in the field of electronic money is a company, which regular activity is an electronic money issue. To work, you need to obtain an Emi license (Estonia).

The main regulator of Ireland, which is responsible for electronic money licensing, is the Central Bank.

Latvia is one of the countries that adopted the EU Directive of 2009, which defines the rules for the operation of e-money issuers and payment licenses.

Poland, which is a member of the EU since 2004, must be guided by the Second EU Directive and the requirements of GDPR Regulation when considering the e-money and payment licenses issue.

Slovakia complies with the General Norms of the European Union, including directives relating to the activities of payment licenses operating in fiat and non-fiat (electronic) currencies.

Legal entities that need a license payment license in Spain, must be registered in the country – for example, as sociedadanónima.

Having a favorable legal and tax environment for fintech businesses, Cyprus has positioned itself as a recognized and reputable financial and business center.

Foreign holders of documents have the right to perform transactions with electronic money within the jurisdiction, but for this they need to open a division or a branch office of their legal entity in the country.

The EU directives are in effect in Austria. According to them, the financial-virtual instruments are divided according to the base of creation: hardware (in particular, digital wallets) and software products – “electronic cash”.

After an adoption of the second EU Directive, Belgian legislation expanded the e-money use for residents and foreign entrepreneurs, but such activities must be licensed in FSMA Office.

Payment licenses, operating on the basis of plastic cards and electronic Internet tools work in the market successfully and for a long time.

In 2017-2018 the Danish National Payment License Regulator finalizes a preparation to the second EU Directive terms transition. Prior to this, FSA was guided by provisions of the local Law on Payments and Electronic Money.

Georgian legislation regulating the electronic money and related services sphere (the Law on the Payment license, on the National Bank and other acts) obliges entrepreneurs to license activities.

Entrepreneurs who want to become German electronic money operators must apply to Federal Financial Supervision Agency.

Iceland opens vast opportunities for the crypto-currency business.

Luxembourg payment license obligates all payment license makers to obtain a license from a local FCA regulatory authority.

The Republic of Macedonia is potentially interesting for business in e-money

Malta obligates all payment licenses owners, issuers of electronic money to receive a special license.

Several years ago, Montenegro took large-scale steps to introduce electronic money circulation in the legal field.

In early summer of 2018, the Romanian government took emergency measures in the field of electronic money regulation and EMI activities in the country.

Serbia, although is not a member of the EU, aspires to become a member thereof, therefore, it adheres strict European rules in relation to e-money, but does not extend the validity of licenses from EU countries to its territory.

On 28 January 2020, Monetary Authority of Singapore (MAS) announced the introduction of Singapore Payment Services Act with the aim of enhancing the regulatory framework for payment services in Singapore.

N5Bank assists our international clients to secure Cryptocurrency license in Dubai. The two available are cryptocurrency exchange license and cryptocurrency wallet license.

Applying for a Bahrain Crypto Asset Service Provider License is hassle free with N5Bank assistance.

N5Bank team of licensing experts has years of experience assisting international clients to secure a Czech Crypto License.

The two available are cryptocurrency exchange license and cryptocurrency wallet license.

At the start of the engagement, our team of experts will explain all mandatory requirements for the license applications.

N5Bank assist our international clients to secure a Barbados offshore banking license.

N5Bank team of licensing experts has years of experience assisting international clients to secure a crypto license in Bulgaria.

N5Bank assist our international clients to secure a Cayman Islands banking license. Our service package includes Caymanian company registration, recruiting local employees, drafting license applications, and supporting documents like AML/CFT policies.

We ensure the smooth flow of your license application from the very first step of entity formation to the ultimate submission of the license application.

N5Bank team of licensing experts has years of experience assisting international clients to secure a Cyprus crypto license.

N5Bank assists our international clients to secure USA MSB license to legally start business in Delaware.

The two available are cryptocurrency exchange license and cryptocurrency wallet license.

N5Bank assists our international clients to secure Lithuania Payment Institution License.

Puerto Rico has established itself as one of the leading financial and banking centers within the Caribbean.

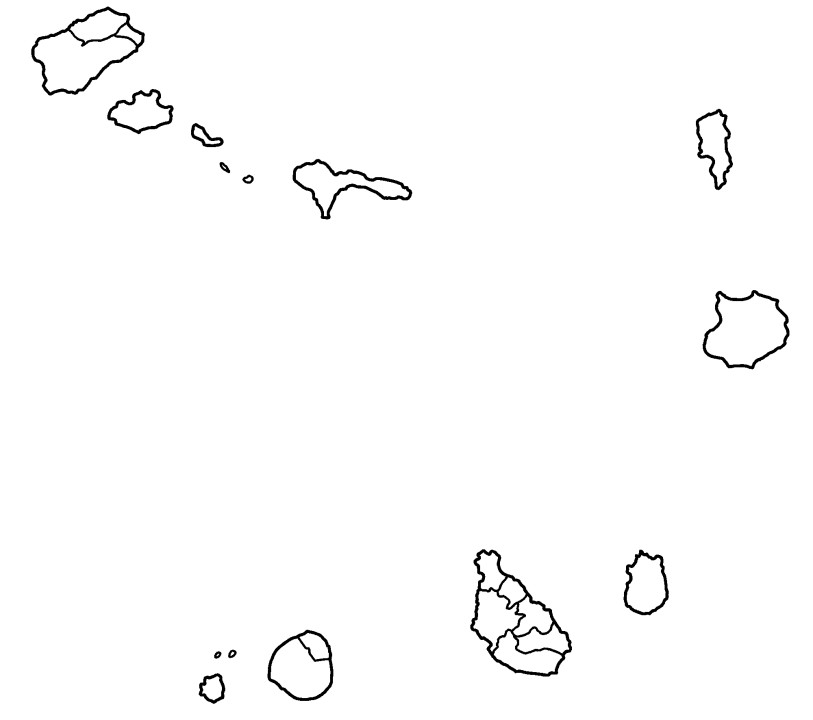

The countries of the African continent are becoming popular jurisdictions for entrepreneurship associated with the financial sector, blockchain, and cryptocurrencies.

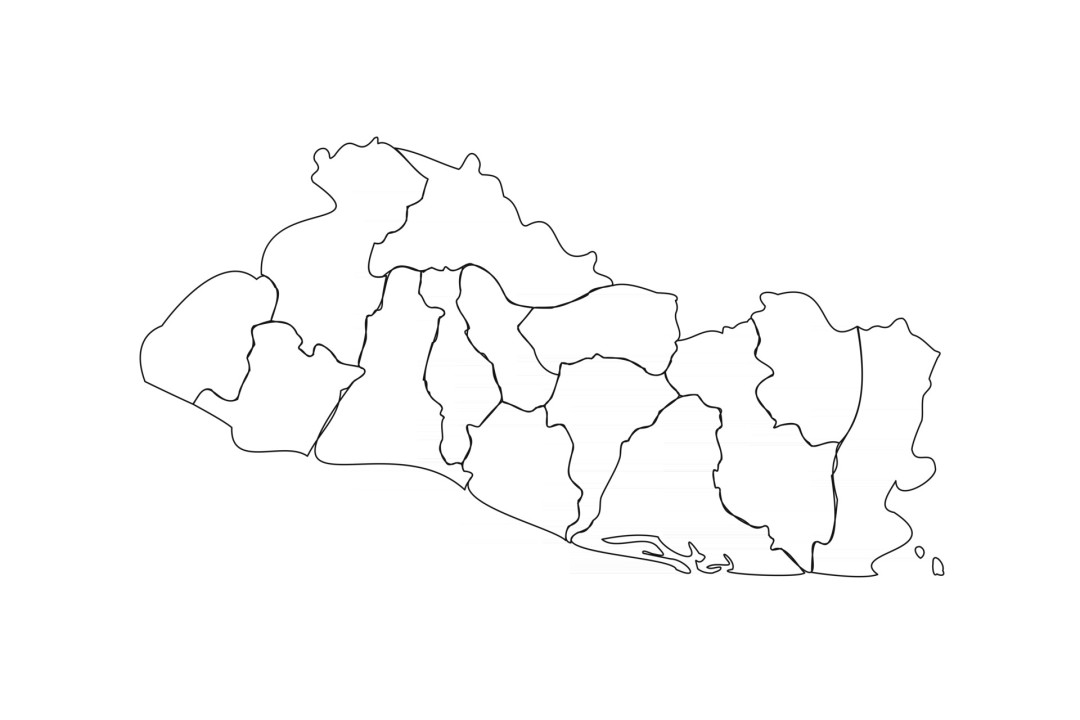

By integrating Bitcoin as an official currency in the country, El Salvador became a pioneer in June 2021, which was a big leap in the adoption of digital currency.